The Military Wallet

By Jon Rehagen ·

Advertiser Disclosure: The Military Wallet and Three Creeks Media, LLC, its parent and affiliate companies, may receive compensation through advertising placements on The Military Wallet. For any rankings or lists on this site, The Military Wallet may receive compensation from the companies being ranked; however, this compensation does not affect how, where, and in what order products and companies appear in the rankings and lists. If a ranking or list has a company noted to be a “partner,” the indicated company is a corporate affiliate of The Military Wallet. No tables, rankings, or lists are fully comprehensive and do not include all companies or available products.

The Military Wallet and Three Creeks Media have partnered with CardRatings for our coverage of credit card products. The Military Wallet and CardRatings may receive a commission from card issuers. You can read more about our card rating methodology here.

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more information, please see our Advertising Policy.

American Express is an advertiser on The Military Wallet. Terms Apply to American Express benefits and offers.

Understanding your taxes is a big part of financial planning, whether you’ve already retired or are in the midst of your career. Very few factors can impact how your income is taxed more than where you live, and with the frequency that legislation at the state and local levels changes, it’s important to stay up-to-date on current tax policies affecting military retirement pay.

Currently, two states that tax military retirement pay are considering adjusting their policies:

1. Delaware: As of January of 2025, there is still a bipartisan bill in the state legislature aiming to get rid of its age requirement for its military retirement pay tax exemption. It would also gradually increase the exemption amount from $12,500 to $25,000 in three years for all retired military personnel. However, it is still pending.

2. California: Efforts to pass a bipartisan bill to eliminate state income taxes on military retirement pay and spouses covered in the Surviving Benefit Plan (SBP) failed.

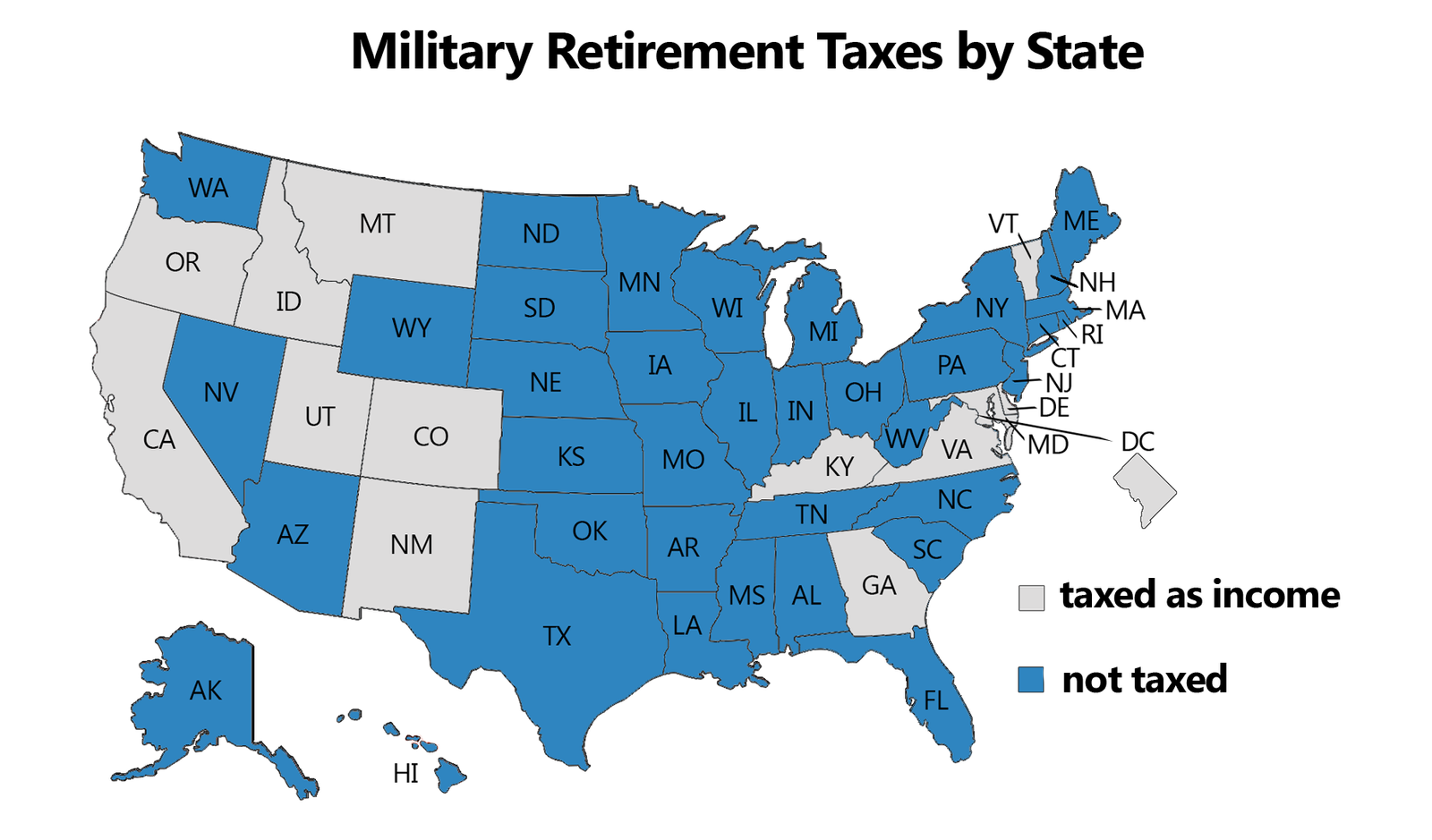

Currently, 37 states don’t tax military retirement pay at all. Those states either have specific policies excluding military retirement pay from income tax or are states that don’t tax any type of income.

Figuring your military retirement pay into taxes is more unique than civilian retirement pay in two aspects. First, it can affect someone older, whose monthly budget may be fixed based on the pension. A civilian retirement is taxable income in the states where it is collected. But your monthly budget is larger if you’re retired military, and the state you live in offers an exemption for military retirement pay.

Secondly, taxes on military retirement can affect someone younger pivoting to a civilian career but still eligible for a retirement pension. If a state offers an exemption for military retirement pay, their monthly budget will be larger than those with retirement tax policies. The added ripple comes in states with partial exemptions on military retirement pay. They tend to have age-related policies, so if you serve two decades of active-duty service and retire in your 40s, you may be limited on how much annual retirement pay can be deducted from state income taxes.

Twelve states partially tax military retirement pay or provide limited exclusions based on individual circumstances. California is the only state that fully taxes military retirement pay as income. However, Washington, D.C. also fully taxes military retirement pay as income.

As recently as the 2022 tax year, Indiana, Nebraska, and North Carolina passed laws ending income tax on military retirement pay.

States with a partial exemption on military retirement pay have varying tax policies, which are laid out below.

As mentioned earlier, where you live impacts your income taxes. It’s such a big deal, that servicemembers often move from states with higher state income taxes to states with low or no income tax to retire.

“Each state has a variety of additional benefits and privileges for veterans and retirees that should be considered. For example, some states have property tax exemptions, free state park passes, and military discounts,” Stacy Miller, CFP and founder of BayView Financial Planning said. Later, alluding to taxes impacting professional transitions, “As military service members usually retire well before the traditional retirement age, proximity to an encore career, family, and lifestyle choices are all a part of the overall decision.”

When breaking down U.S. Census data, the Tax Foundation, a non-profit organization researching the impact of state, federal, and national taxes, found states with higher taxes saw the most outbound migration, meaning people leaving the state. States with lower income taxes were among the leaders in inbound migration, or people moving to the state.

Note: Of the states in the top 10 of inbound migration, 7 offer tax exemptions for either state income taxes or military retirement pay.

Financial experts see taxation, particularly on military retirement pay, as a motivating factor for where military families choose to live.

“Fort Moore is technically in both Georgia and Alabama, so service members and veterans can live in either state and still commute to the U.S. Army base easily,” Miller said. “When my husband [who retired after 28 years of service with the U.S. Army] and I were stationed at then Fort Benning [now Fort Moore], the Alabama community and state leaders would often discuss their state income tax exemption at ceremonies and social events as an incentive to retire in Alabama.”

It’s one thing to talk about tax percentages, it’s another to show you the difference. So let’s imagine you were stationed at Fort Moore and retired as a Sergeant First Class at 39 years old after 21 years in the Army. In this hypothetical situation, say you want to start a business to earn $55,000 annually.

Your monthly retirement pay amounts to $2,808.23, giving you an annual total of $33,700. If you decide to live in a state like Alabama, which does not tax military retirement pay, this income remains untaxed.

However, in this scenario, say you choose to live in Georgia, which offers a $17,500 exemption for military retirees under 62, you’ll have $16,200 of your retirement as taxable income. When adding this to your business earnings, your total taxable income becomes $71,200. At Georgia’s flat tax rate of 5.49%, you would pay $3,908.88 in taxes. In contrast, in Alabama, only your income from the business is taxed at 4.18%, totaling $2,299 in taxes. It comes to a difference of $1,609.88 in taxes!

The Military Wallet’s methodology:

*Rate data provided by RateUpdate.com. The displayed rates come from multiple providers and represent market averages. Your mortgage rate will differ based on individual factors like your credit score as well as differing loan types and terms offered by lenders.

Click “Get Your Actual Rate” to connect with a licensed mortgage lender for a more accurate quote.

Military retirees pay federal taxes on retirement pay. However, some situations may impact your retirement pay. A common one is receiving VA disability compensation due to a service-connected disability rating.

VA disability compensation is nontaxable, however, retirement pay becomes affected when servicemembers are eligible for both benefits.

Your disability rating determines whether you can receive military retirement pay and VA disability compensation concurrently (without offset). Military retirees with a service-connected disability rating of 50% or higher or a combat-related disability rating of 10% or higher receive concurrent receipt, which has no impact on military retirement pay.

Those with a service-connected disability rating of 40% or less are ineligible for concurrent receipt and have their military pension reduced by the amount of disability compensation they receive from the VA. The amount from the VA is nontaxable. The net effect is to receive the same amount of income. However, the portion from the VA is tax-exempt, which lowers your effective taxable income.

Just remember, taxes are only a small factor in your relocation decision. You should consider all your priorities and make the decision that best suits you.

See author's posts

Posted In: Active Duty Featured Guard/Reserves Military Pay Military Retirement Taxes

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

says

I have a Question ?? Above 50% disability is mentioned and less than 40% as well. My question is what is going on between 40% and 50%. Thank you for your post.

says

Hello J.K., thank you for your question. Disability ratings are awarded in 10 point increments. So you can have either 40% or 50%, but nothing in between.

says

Thanks so much for this information. Is the information outlined in the article applicable to disability pay as well? Meaning, disability pay for a service related disability would have the same tax treatment applied?

says

Hi Sadie, that may depend on the state. Which state are you asking about?

says

USAR SM here. HOR is IL. Since joining the mililtary back in 2012, IL has never taxed my military income. You may want to update that on this list. I was AD 2012 to 2017, then Reserves 2017 to current. Again, IL has never taken out state income tax from my military pay.

says

Thank you, Damion. Some states, including IL, do not take military pay. However, this article is focused on military retirement pay. We don’t have an article that covers which states tax military income from those who are still serving. Thanks!

Load More Comments

Explore Our Site:

Follow Us:

© Three Creeks Media, LLC 2025. All Rights Reserved.

The Military Wallet is a property of Three Creeks Media. Neither The Military Wallet nor Three Creeks Media are associated with or endorsed by the U.S. Departments of Defense or Veterans Affairs. The content on The Military Wallet is produced by Three Creeks Media, its partners, affiliates and contractors, any opinions or statements on The Military Wallet should not be attributed to the Dept. of Veterans Affairs, the Dept. of Defense or any governmental entity. If you have questions about Veteran programs offered through or by the Dept. of Veterans Affairs, please visit their website at va.gov. The content offered on The Military Wallet is for general informational purposes only and may not be relevant to any consumer’s specific situation, this content should not be construed as legal or financial advice. If you have questions of a specific nature consider consulting a financial professional, accountant or attorney to discuss. References to third-party products, rates and offers may change without notice.

Advertiser Disclosure: The Military Wallet and Three Creeks Media, LLC, its parent and affiliate companies, may receive compensation through advertising placements on The Military Wallet. For any rankings or lists on this site, The Military Wallet may receive compensation from the companies being ranked; however, this compensation does not affect how, where, and in what order products and companies appear in the rankings and lists. If a ranking or list has a company noted to be a “partner,” the indicated company is a corporate affiliate of The Military Wallet. No tables, rankings, or lists are fully comprehensive and do not include all companies or available products. You can read more about our card rating methodology here.

Editorial Disclosure: Editorial content on The Military Wallet may include opinions. Any opinions are those of the author alone, and not those of an advertiser to the site nor of The Military Wallet.

Information from your device can be used to personalize your ad experience.