Russia’s Rubble vs Russia’s Currency Reserves Source: Bloomberg

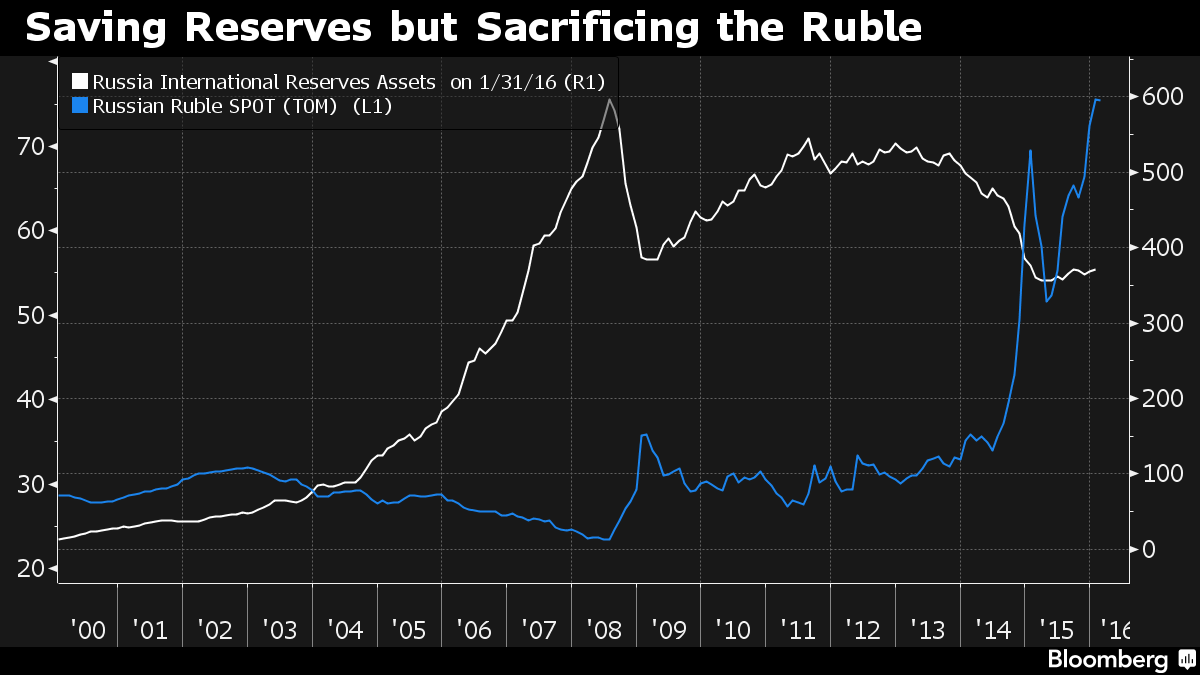

By this time last year, the Russian currency was in a tailspin. Its foreign reserves dropped by a massive 26% from $510 billion in January 2014 to $376 billion within a year spending a massive $134 billion defending its currency.

The move did not work as the currency which had plunged by 50% in the past year continued its downward spiral. Something had to give as the country could not stand losing on both sides, currency slide and drop in reserves. And so Russians decided to stop defending the currency leaving it to the fate of market forces. The result was high volatility with the price oscillating against the dollar in a swing that made it difficult for any inexperienced speculator to ride.

Russia in essence had decided to float its currency. The result of floating its currency has been mixed to say the least. The economy has been in recession, Consumer prices jumped 12.9 percent last year, the biggest calendar-year rise since 2008 according to Bloomberg. High volatility has also hurt importers of raw materials and goods and services. Input cost has skyrocketed and prices are almost beyond the reach of consumers making some of them post losses.

That’s the downside of floating a currency. The upsides are that the government at least preserved its currency reserves which it can deploy to better use as oil prices continue to nose dive. It also controls demand in a way free markets would as speculators are effetely reduced to currency traders happy to ride the wave of volatility. Their reserves is yet to drop from its year low of $350 billion recorded in April 2015 and has risen since then to $376 billion.

Nigeria’s foreign currency reserves is currently at about $27.8 billion down from about $31.5 billion a year ago. It could have been worse were it not for the stiff capital controls which was introduced early 2015. Even though analysts believe capital controls had more negative impact on the value of the naira than the speculative activities of a few. Due to restrictions, people are front loading demand as they do not want to face of liquidity squeeze when they need to consummate a transaction.

I have often proposed that we float the Naira as against devaluing the currency or retaining the fixed regime we currently have. When you float the Naira, a market determined exchange rate will suffice and the black market will gradually become ineffective. A lot of Nigerians who kept billions of dollars in bank vault may also be incentivized to sell some of it providing the liquidity that has evaded the forex market for months. The CBN will also intervene from time to time if they still want to influence prices by injecting forex if they observed that a supply gap. Of course, the downsides exist but this will encourage the local manufacturers to become more innovative and improve the quality of their produce.

There will also be more dire consequences for the country as the entire fabric of our economy as we know it today will change.

In a nutshell, if we decide to float the naira the following could happen;

Nairametrics is Nigeria’s top business news and financial analysis website. We focus on providing resources that help small businesses and retail investors make better investing decisions. Nairametrics is updated daily by a team of professionals. Post updated as “Nairametrics” are published by our Editorial Board.

Your email address will not be published.

Follow us on social media:

© 2025 Nairametrics

Login to your account below

Fill the forms below to register

Please enter your username or email address to reset your password.

© 2025 Nairametrics