The US Dollar Index (DXY), which tracks the Greenback against a basket of currencies, ticks higher for the second straight day on Friday, though it lacks bullish conviction. Moreover, the fundamental backdrop warrants some caution before positioning for an extension of the overnight bounce from a two-and-a-half-week low.

Data released on Thursday pointed to a still resilient US labor market. Adding to this, a first look at S&P Global’s PMI revealed employment strength across both the manufacturing and services sectors, which, along with intensifying price pressures, suggests that inflation could accelerate in the second half of the year. This reinforces the market view that the Federal Reserve (Fed) will keep interest rates unchanged at the upcoming meeting next week and turns out to be a key factor acting as a tailwind for the US Dollar (USD).

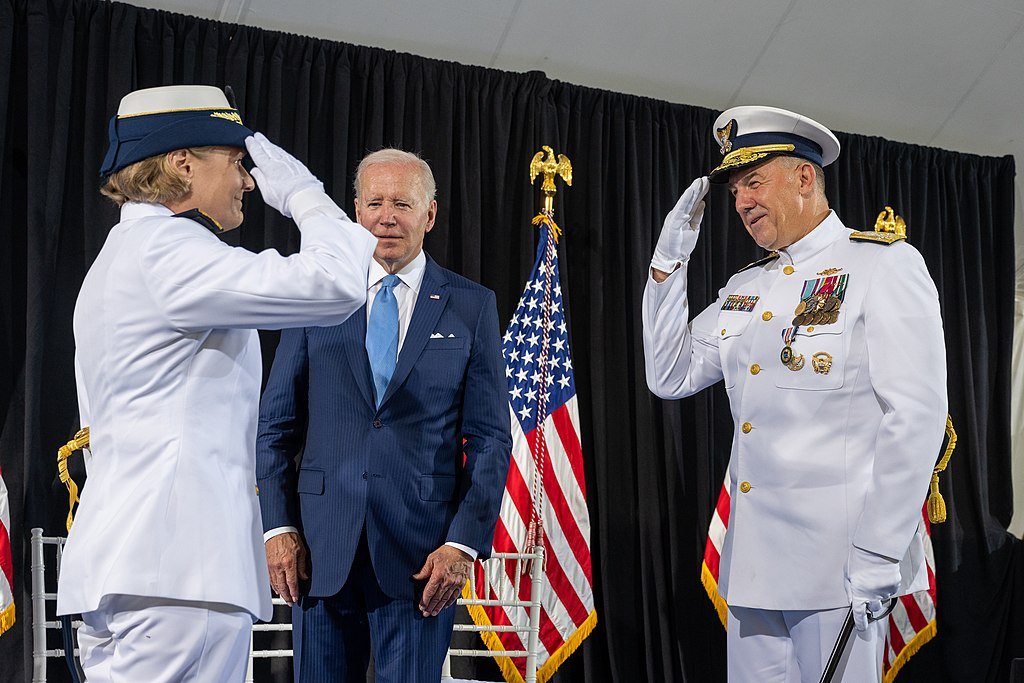

Meanwhile, US President Donald Trump continued to dial up the pressure on Fed Chair Jerome Powell and expressed his desire for lower interest rates during a rare visit to the central bank’s headquarters. Furthermore, investors remain worried that the Fed’s independence could be under threat on the back of mounting political interference. This, along with concerns about the potential negative economic impact from higher import prices, is holding back the USD bulls from placing aggressive bets and capping any further gains.

Investors also seem reluctant and might opt to wait for more cues about the Fed’s rate-cut path. Hence, the focus will remain glued to the outcome of a two-day FOMC monetary policy meeting, starting next Tuesday. In the meantime, Friday’s release of US Durable Goods Orders might influence the USD price dynamics later during the North American session. Nevertheless, the DXY seems poised to register losses for the first time in three weeks, though the mixed fundamental backdrop warrants some caution.

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

GBP/USD struggles to hold its ground and trades slightly below 1.3500 in the European session on Friday. The data from the UK showed that Retail Sales rose at a softer pace than expected in June, making it difficult for Pound Sterling to stage a rebound.

The EUR/USD pair ticks lower for the second consecutive day on Friday and moves away from a nearly three-week top touched the previous day. Spot prices, however, lack follow-through selling and currently trade around the 1.1740 region, down less than 0.10% for the day.

Gold price attracts sellers for the third straight day amid some follow-through USD strength. Trade optimism remains supportive of the upbeat mood and undermines the precious metal. The Fed uncertainty could cap the USD and help limit losses for the non-yielding commodity.

Bitcoin price continues to trade within a tight consolidation range on Friday, suggesting a pause in bullish momentum. Meanwhile, Ethereum and Ripple have slid nearly 3% and 10%, respectively, so far this week. Traders should be cautious as the momentum indicators of these cryptocurrencies show signs of fading bullish momentum.

The first six months of Trump’s second presidency have been characterized by bold rhetoric, policy ambiguity, and a renewed push for “America First” priorities—from trade and tax to AI and national defense.

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

©2025 "FXStreet" All Rights Reserved

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.